GST Refund

Essentials of GST Refund:

Reorganizing and standardising the return procedures is made possible by the GST law’s refund provision.

Because the process for requesting a refund under GST is uniform to prevent confusion, an appeal for a GST refund may be necessary when the amount of Tax paid exceeds the amount of GST owed.

The refund process facilitates trade by allowing blocked funds to be used for a variety of purposes, including working capital, corporate expansion, and modernization.

Once it is identified that there is a case for claim GST refund then one has to file for the claim through GST Refund Form RFD-01.

The GST claim must be submitted within two years of the “relevant date” of the GST refund application, preferably with the assistance of a licenced Chartered Accountant.

There are several circumstances in which a refund may be requested, including tax refunds to foreign visitors, refunds for taxes paid by the Embassy or UN agencies, refunds upon the completion of a provisional assessment, etc.

A refund can be appealed in Goods and Services Tax (GST) in the given Circumstances:

- Products or Services That Are Considered Exports.

- Refund of Unutilized Input Tax Credit.

- Refund from Manufacturing / Generation/ Production of tax-free supplies.

- Excess payment due to mistake and inadvertence.

- Finalisation of the preliminary assessment.

- Refunds of taxes paid on purchases made by UN organisations, CSD canteens, paramilitary forces, etc.

- Pre-deposit repayment in the event of an appeal.

How SalahKaro Helps?

Assistance with claim calculation, evaluation, and submission to the relevant authority.

Whenever possible, assistance in helping clients get clarification from the department.

Assisting in the creation of replies to departmental inquiries or potential audits.

Help in completing any necessary follow-up with the GST administration to obtain the refund

Assistance with appeals in the event that the refund request is rejected or the relevant authority takes no action.

FREQUENTLY ASKED QUESTIONS

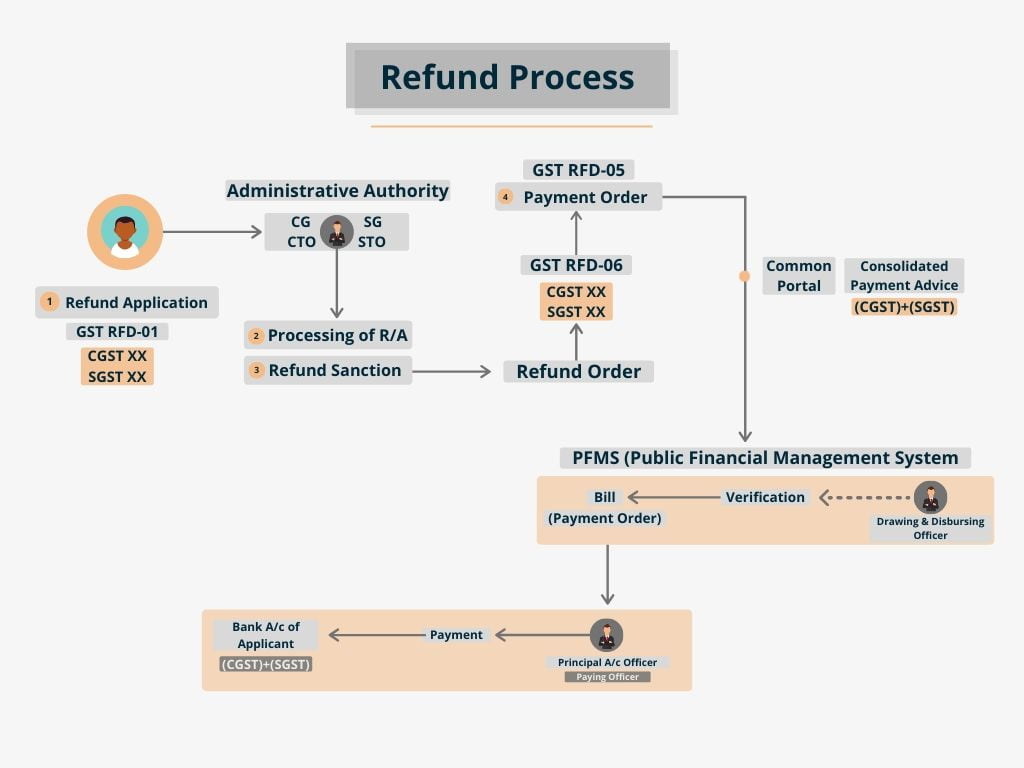

GST refund application should be filed in GST RFD-01. It is an entirely online process and all the relevant documents shall be uploaded online. After filing the refund application, an acknowledgment shall be generated in Form GST RFD-02. Once the application is scrutinized by the department, it will be sanctioned by issuing of sanction order in Form GST RFD-06. Thereafter, a payment order will be issued in Form GST RFD-05 leading to payment of a refund.

If there are no queries pertaining to your GST refund, then your GST refund application shall be processed and sanctioned within 60 days of filing the application. Therefore, the GST refund time limit is anywhere between 30 days to 60 days.

Often, GST refund gets delayed due to procedural aspects. As the money is blocked into the system, it creates short-term hardships for the taxpayers. Therefore, the government has introduced the concept of provisional refunds for GST whereby a refund is released by the department temporarily up to 90% before the scrutiny of documents and related records gets completed. Provisional refunds are applicable in the case of zero-rated supplies. That includes exports of goods or services or supplies made to Special Economic Zone Developers or Units. Provisional refunds shall be issued in Form RFD-04 within 7 days after the issue of acknowledgment in Form RFD-02.

A person seeking a refund of GST shall file the GST refund application before the expiry of 2 years from the relevant date as is mentioned in Explanation to Section 54 of the CGST Act.

Yes. GST refunds cannot be claimed if the amount of the refund is less than Rs. 1000.